“`html

Effective Ways to Calculate Marginal Cost in 2025 for Improved Profitability

Understanding the Basics of Marginal Cost

Before diving into calculating marginal cost, let’s first establish a clear definition. The marginal cost is defined as the additional cost incurred by producing one more unit of a good or service. This concept is vital in both cost management and profit maximization. Understanding fixed costs and variable costs is key to accurately determining marginal cost. Fixed costs remain constant regardless of how much output is produced, while variable costs fluctuate with production volume. Together, these components form the basis of a company’s cost structure, influencing decisions such as pricing strategies and overall profitability.

The Formula for Marginal Cost

The formula for marginal cost is relatively simple: it is calculated as the change in total cost that arises from producing one additional unit of product. Mathematically, this can be expressed as:

Marginal Cost (MC) = Δ Total Cost / Δ Quantity

In this formula, Δ denotes the change in a variable. For example, if increasing production from 100 to 101 units raises the total cost from $1,000 to $1,020, the marginal cost can be calculated as:

MC = ($1,020 – $1,000) / (101 – 100) = $20

This indicates that each additional unit produced incurs an expense of $20. Understanding this calculation is essential for business cost analysis and ensures that decisions made are effective in maintaining profitability.

Components of Marginal Cost Calculation

Calculating marginal cost accurately requires considering several components. First, it’s crucial to gather accurate data about your total costs. This includes costs like direct costs, indirect costs, and cost of goods sold. You may also need to utilize cost calculation methods that help break down these various costs into fixed and variable expenses.

Next, it’s vital to adjust your calculations as production scales. Production output levels and efficiency metrics, such as capacity utilization, also affect marginal cost. Knowing how production efficiency can enhance your firm’s resource allocation and lead to improved marginal cost insights can significantly influence strategic decisions.

Tools for Calculating Marginal Cost

In today’s digital age, various tools and calculators are available for marginal cost analysis. Utilizing a marginal cost calculator simplifies the computation, ensuring that businesses can quickly adapt to changes in cost structures as production volumes change. Additionally, employing software that analyzes marginal revenue alongside costs helps businesses maintain a sustainable balance for effective cost accounting. This prepares companies to react swiftly to market conditions, ensuring decisions are based on timely and accurate financial data.

Case Study: Implementing a Marginal Cost Calculator

Consider a manufacturing company that produces widgets. They implemented a marginal cost calculator due to rising concerns over production costs amidst fluctuating material prices. By integrating this calculator, they could easily assess how changes in their cost of production affected overall profitability.

The company discovered that a small increase in production could lead to significant reductions in the average cost per unit due to economies of scale. By carefully analyzing this data, they made informed decisions about scaling production, which enhanced their operational efficiency and overall profit margins.

The Impact of Economic Conditions on Marginal Cost

Marginal cost is not just an internal consideration; it is also profoundly affected by external economic conditions. For instance, significant changes in demand elasticity or shifts in market conditions require businesses to constantly reevaluate their marginal cost. Financial forecasting can utilize data analysis to predict changes in production costs, allowing businesses to adjust their pricing strategies efficiently, making informed decisions that align with current economic theory and principles.

Long-Run vs. Short-Run Marginal Cost

Arguments often arise regarding the differences between short-run marginal cost and long-run marginal cost. Understanding this distinction is critical. In the short run, some costs remain fixed, while others vary with production levels. Short-run analysis helps businesses adjust to immediate changes in production circumstances.

Implications of Long-Run Marginal Cost on Business Strategy

The long-run marginal cost, however, considers future planning, where all costs are variable, impacting budgeting and financial planning strategies. It’s crucial for organizations aiming for growth to be aware of how their cost structure will adapt over time. This means examining future projections of cost of production, selecting to invest in efficient processes that lower future marginal costs, ultimately aiding in sustaining competitive advantage.

Strategic Cost Management and Profit Maximization

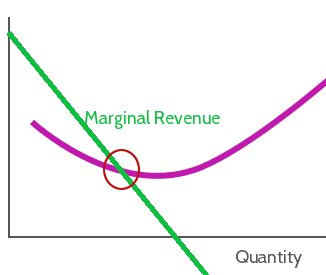

To maximize profits, businesses should employ marginal analysis to compare the additional benefits of output changes against the marginal costs involved. Implementing specific cost reduction strategies, such as reviewing expenditures or enhancing production efficiency, may enable a firm to lower its marginal costs. The goal becomes clearer: finding the output level where marginal cost and marginal revenue align, achieving optimal profits.

Key Takeaways

- Understanding marginal cost is critical for efficient cost management, as it helps businesses make data-driven decisions about pricing and production.

- Utilizing tools such as marginal cost calculators can enhance accuracy and speed in cost accounting.

- Recognizing the distinction between short-run and long-run marginal costs is essential for effective financial planning.

- Implementing cost reduction strategies and improving production efficiency can significantly impact a firm’s overall profitability.

- Regularly reviewing economic conditions is necessary for ensuring that business strategies remain relevant and aligned with market dynamics.

FAQ

1. What is the definition of marginal cost?

Marginal cost refers to the increase in total cost accrued by producing one additional unit of a product or service. It is a crucial concept in economic decision-making, impacting pricing and resource allocation strategies for businesses.

2. What are variable costs, and why are they important for calculating marginal cost?

Variable costs fluctuate in relation to production output, directly influencing the marginal cost calculation as production levels change. Understanding these costs allows businesses to adapt to operational efficiency and maintain profitability.

3. How does the marginal cost curve affect production decisions?

The marginal cost curve demonstrates the relationship between quantity produced and the marginal cost incurred. By analyzing this curve, businesses can find the optimal output levels that maximize profits while controlling costs effectively.

4. What role does opportunity cost play in marginal cost calculations?

Opportunity cost reflects the potential benefits missed when choosing one production option over others. Considering this in marginal cost calculations allows companies to assess the true cost of production decisions and make informed choices.

5. How can businesses utilize marginal cost pricing strategies?

Businesses can adopt marginal cost pricing by setting prices just above marginal costs to ensure profitability while remaining competitive in the marketplace. This strategy helps maintain a balance between profitability and affordability for consumers.

“`