How to Effectively Calculate Consumer Surplus in 2025: A Practical Guide to Understanding Market Benefits

Understanding consumer surplus is essential for analyzing **market benefits** in economics. In 2025, as markets evolve, the ability to accurately **calculate consumer surplus** remains a critical skill for economists and market analysts. This guide will walk you through the steps of understanding consumer surplus, its implications, and practical tips for measurement. We will explore the **consumer surplus definition**, the **consumer surplus formula**, and the various elements that impact this essential economic concept.

Understanding Consumer Surplus

Before you can effectively calculate consumer surplus, it is important to grasp its **definition** and relevance in economics. **Consumer surplus** represents the difference between what consumers are willing to pay for a good or service and what they actually pay. This concept not only reflects the **economic efficiency** of markets but also offers insight into **consumer welfare**. The measure of **consumer benefits** aids in assessing how changes in market prices affect consumer behavior and overall economic conditions.

Consumer Surplus Formula

The **consumer surplus formula** is fairly straightforward: it is the area between the **demand curve** and the **market price**. Mathematically, consumer surplus can often be calculated using the formula: Consumer Surplus = 1/2 * (Base * Height), where the base equates to the **quantity sold** and the height is the difference between the **maximum price** consumers are willing to pay and the actual **market price**. For example, suppose the maximum price a consumer is willing to pay for a product is $50, while the market price is $30. In this scenario, consumer surplus would be calculated using the volume of transactions, providing a clear monetary benefit to consumers, enhancing their **consumer welfare**.

Illustrating Consumer Surplus

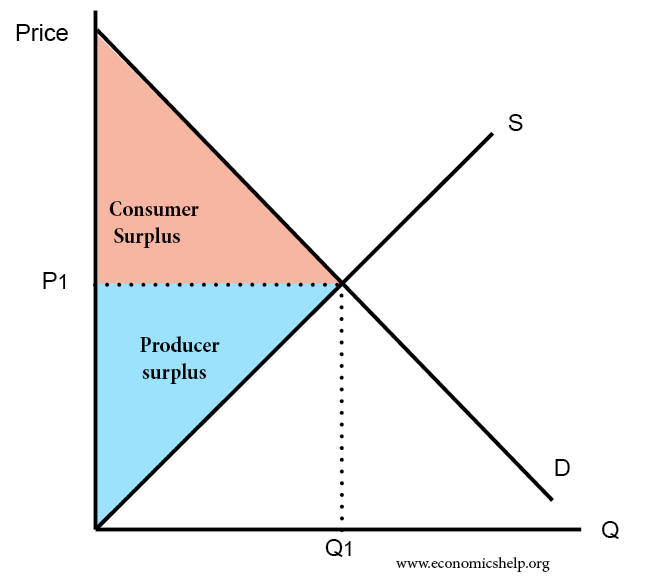

Visual aids often enhance comprehension. Utilize graphs to depict consumer surplus, showcasing the area between the **demand curve** and the **market price**. A common example is creating a graph where the demand curve slopes downward, tangent to the supply curve at the market equilibrium. This graphical representation not only simplifies the concept of **surplus area** but also highlights shifts in demand or supply that may influence consumer surplus significantly. Through a clear illustration, stakeholders can easily assess the impact of external factors such as **price reductions** and **market interventions**.

Factors Affecting Consumer Surplus

The **importance of consumer surplus** stems from its ability to indicate how well markets function in providing value to consumers. Several factors can significantly affect consumer surplus, such as **price elasticity** of demand and **changes in consumer preferences**. Understanding these aspects allows for comprehensive economic analysis, especially during market fluctuations.

Price Elasticity and Consumer Surplus

**Price elasticity** refers to the responsiveness of **consumer demand** to changes in price. A highly elastic demand results in significant changes in consumer surplus when prices fluctuate. For instance, if a consumer chooses to buy a product primarily based on its promotion or price drop, their consumer surplus is likely to increase dramatically. Understanding **elasticity of demand** provides insight into how consumers alter their buying behavior in response to various **market dynamics**. Analyzing how different brands approach pricing can also show their strategies aimed at maximizing their respective consumer surplus.

Consumer Preferences and Behavior

Changes in **consumer preferences** can profoundly affect **surplus measurement**. For example, if new technology makes a competitor’s product more desirable at a similar price, consumers may shift their purchases, increasing consumer surplus for the new product. In practice, **understanding consumer behavior** through surveys and market studies can provide valuable data on preferences, leading to better predictions about consumer surplus in changing markets.

Application of Consumer Surplus in Policy Making

**Policies that influence market outcomes**, such as subsidies or taxes, directly affect consumer surplus. Recognizing these implications can guide effective decision-making when developing **economic reforms**.

Policy Implications for Consumer Surplus

Policy-makers should consider how regulations impact **consumer behavior** and welfare economics. For example, if a set **price ceiling** is established on essential goods, it may artificially inflate consumer surplus in the short term but can lead to shortages over time. By understanding these dynamics, policy adjustments can be tailored to balance both **producer surplus** and **consumer surplus** in a sustainable manner.

Effects of Taxes on Consumer Surplus

Taxes directly impact consumer surplus by altering prices. When taxes are introduced on a product, it raises the effective price, reducing consumer participation in the market. This connection between taxation and its implications on consumer welfare is crucial for understanding **economic efficiency**. Case studies from various markets have shown that taxes can significantly decrease the equilibrium quantity, thus altering the overall consumer surplus. By modeling potential future scenarios, policymakers can optimize tax strategies that favor sustainable growth and maintain adequate consumer welfare metrics.

Key Takeaways

- Understanding the consumer surplus definition enhances market analysis and consumer behavior insights.

- The consumer surplus formula helps quantify economic welfare efficiently.

- Factors like price elasticity and consumer preferences play significant roles in surplus measurement.

- Policy implications of consumer surplus should be studied to enhance economic efficiency and consumer benefits.

FAQ

1. What is the best way to measure consumer surplus?

The best way to measure consumer surplus is to apply the consumer surplus formula, factoring in the demand curve and market price. Using visual aids such as graphs enhances comprehension and interpretation of surplus areas. Additionally, empirical studies on **consumer behavior** provide valuable insights about fluctuations in consumer surplus during varying market conditions. Calculating using past data on **price differences** offers further accuracy in predictions.

2. How does consumer welfare relate to consumer surplus?

Consumer welfare closely relates to *consumer surplus* as it provides an indication of the economic benefits accruing to consumers from their transactions in the market. Higher consumer surplus typically signals better access to goods and services at lower prices, contributing positively to overall consumer welfare. Understanding the impact of market interventions is essential for enhancing these welfare metrics.

3. What role does price elasticity play in consumer surplus calculations?

*Price elasticity* dramatically affects consumer surplus calculations. When demand is elastic, a small change in price can lead to large variations in consumer surplus. Thus, it becomes essential to analyze how price changes impact overall demand and resultant surplus in practical scenarios.

4. Can consumer surplus change in a monopoly market?

Yes, consumer surplus can significantly change in a *monopoly* market. Typically, a monopolistic market structure results in lower consumer surplus due to higher prices and reduced availability of goods compared to perfectly competitive markets. Analyzing these shifts requires understanding how monopolistic behavior impacts price distribution among consumers.

5. How do taxes impact consumer surplus?

Taxes impact consumer surplus by effectively raising the prices of goods, hence reducing consumer participation and overall satisfaction in the market. The impact of taxes must be carefully analyzed to ensure that policy decisions do not undercut consumer welfare in the long term, finding a balance between necessary revenue for public goods and the resulting consumer surplus.