Comprehensive Guide to How to Use QuickBooks Efficiently in 2025

As businesses continue to navigate an evolving financial landscape in 2025, understanding how to use QuickBooks has become a vital skill for entrepreneurs and finance professionals alike. This comprehensive guide will provide insights into leveraging QuickBooks effectively, covering everything from setup to advanced features. By following these steps, you can make informed decisions to streamline your accounting and financial management processes.

Understanding QuickBooks Features

The first step towards efficient use of QuickBooks is familiarizing yourself with its core features. **QuickBooks accounting** encompasses various tools designed to manage financial transactions seamlessly. Key features include **QuickBooks invoicing**, which enables businesses to create and send invoices directly from the software, and **QuickBooks payroll**, allowing for efficient employee payment management. Exploring these functionalities will provide a solid foundation for utilizing QuickBooks to its fullest potential.

Exploring QuickBooks Invoicing Options

One of the standout features of QuickBooks is its invoicing capabilities. **QuickBooks invoicing clients** can be customized, enabling businesses to reflect their brand while ensuring professional communications. You can set payment terms, automate reminders, and even track whether or not invoices have been paid. With the click of a button, proposals can convert into invoices, easily streamlining the payment process for you and your clients.

Utilizing QuickBooks Payroll Management

Managing payroll in QuickBooks is simplified through state-of-the-art automation tools. With **QuickBooks payroll**, different employee classification types, including full-time, part-time, and contractors, can be efficiently handled. You’ll find time-saving features like tax calculations, direct deposit, and compliance management integrated. Moreover, with **QuickBooks reports**, you can generate detailed payroll summaries to remain informed of your organization’s financial health.

Maximizing QuickBooks Customer Management

Optimizing customer relationships is essential in any business model, and **QuickBooks customer management** tools offer immense value. You can track customer activity, manage contact information, and access transaction histories from one developer tool. Additionally, implementing **QuickBooks automatic backups** will ensure that your customer data remains protected and readily accessible for updates and communications.

Understanding these essential features of QuickBooks sets the stage for more advanced functionalities like **QuickBooks bank reconciliation** and reporting. These tools not only enhance accounting accuracy but also streamline financial oversight.

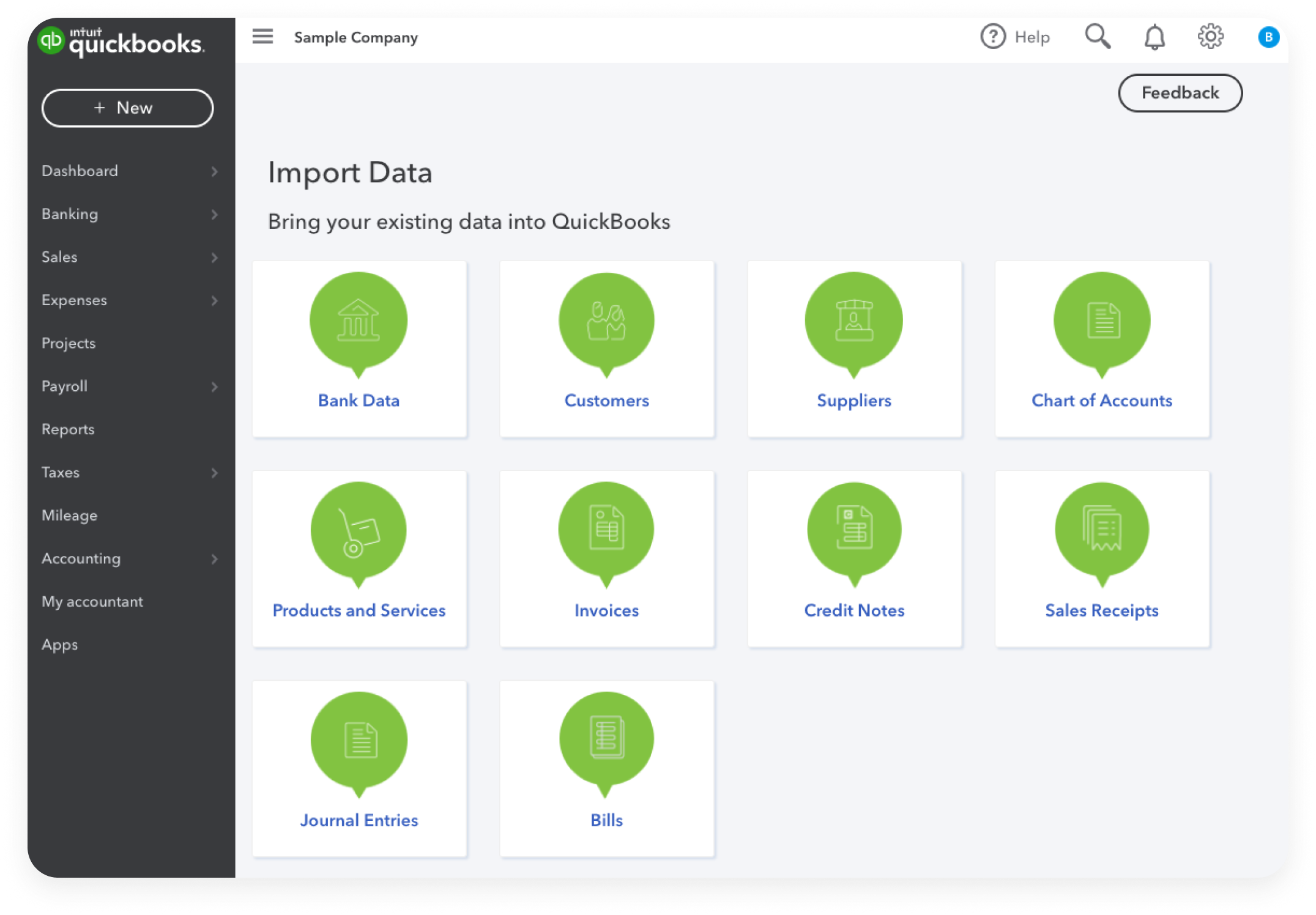

Setting Up QuickBooks for Your Business

Setting up QuickBooks correctly is critical for long-term functionality. The **QuickBooks setup** process can appear daunting; however, following a structured approach can simplify this task. When initiating your **QuickBooks online** or **QuickBooks desktop** software, careful consideration of the chart of accounts and user access will pave the way for a smooth experience.

Creating Your QuickBooks Chart of Accounts

The chart of accounts serves as the backbone of your financial data organization. When setting up your **QuickBooks chart of accounts**, ensure categories are aligned with your financial reporting needs. Each account—be it an asset, liability, equity, income, or expense—should directly reflect your business operations. Periodic reviews of this chart are advisable to ensure effectiveness as your business grows.

Integrating QuickBooks with Other Applications

For a more holistic approach to business operations, integrating QuickBooks with other applications is key. QuickBooks offers flexibility for **QuickBooks integration** with various third-party service providers, including e-commerce platforms for **QuickBooks e-commerce integration**. You can easily sync sales data, improving sales tracking and invoicing procedures for an enhanced user experience. This integration not only saves time but significantly reduces manual entry errors.

Managing Expenses and Financial Reports Effectively

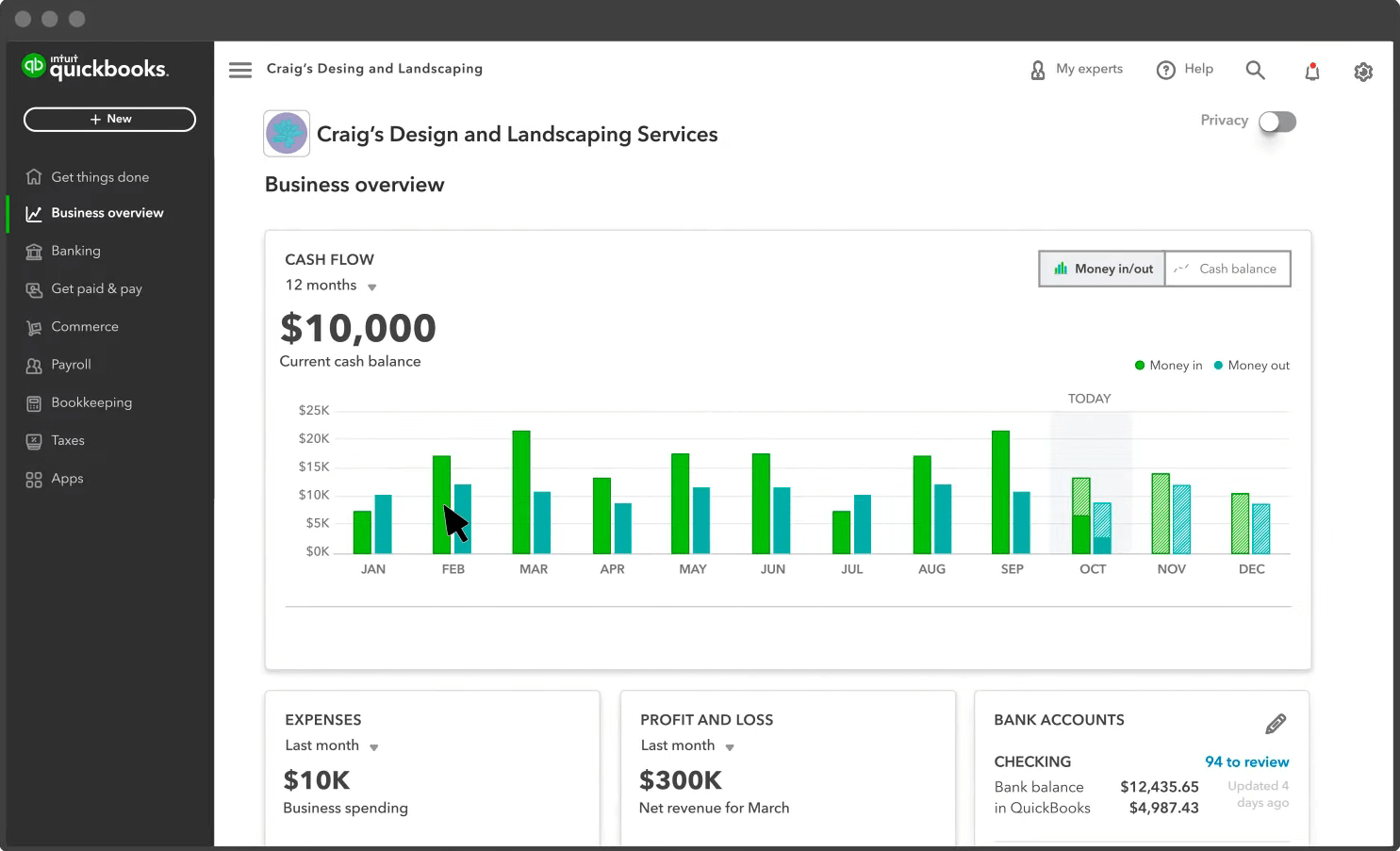

Keeping track of finances is paramount for sustainability in businesses. QuickBooks provides tools to facilitate **QuickBooks tracking expenses** and produce detailed **QuickBooks financial statements**. Understanding how to efficiently manage expenses can result in higher profitability and improved cash flow management.

Implementing QuickBooks Expense Tracking Methods

With **QuickBooks expense tracking**, business owners can log expenses right from their mobile devices or desktops. It is recommended to categorize expenses during entry for streamlined report generation later. QuickBooks provides a variety of automated functionality for **QuickBooks expense management tools** that allow for uploading receipts, segregating tax-deductible expenses, and viewing transaction history with detailed analytics.

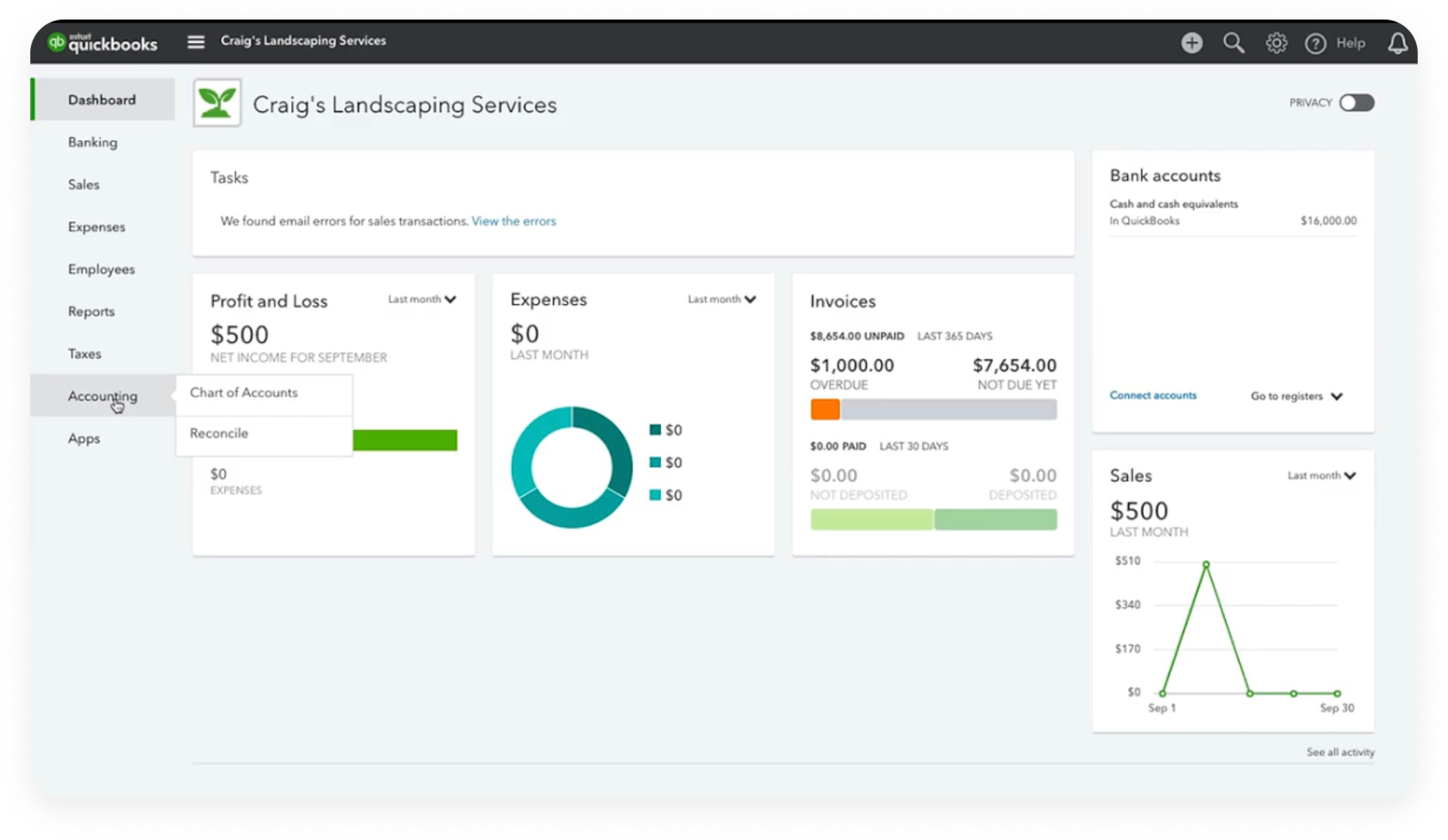

Generating QuickBooks Financial Reports

Reports are integral for making informed decisions. Learning how to use **QuickBooks reports** effectively allows you to see where your business stands financially. Running profit and loss statements, balance sheets, and cash flow reports can offer critical insights. Preparing for tax season becomes simpler with pre-built **QuickBooks tax preparation** assessments that outline expenses and income succinctly. By conducting a **QuickBooks profitability analysis**, businesses can determine which areas are yielding the best results and where adjustments may be necessary.

Leveraging QuickBooks for Enhanced Business Growth

To truly harness the potential of QuickBooks, focus on implementing best practices. Utilizing **QuickBooks training** materials can elevate your usage proficiency and increase productivity across your finance team. Online resources, including **QuickBooks tutorials**, webinars, and community forums, provide abundant information for all levels of users.

Utilizing QuickBooks Customer Support Resources

The vast support options available through **QuickBooks customer support** lead users to greater functionality. Whether through live chat, community forums, or FAQs, many avenues exist to resolve any issues. Establishing best practices, including regular software updates and using the **QuickBooks help center**, can ensure that you are making the most out of the software while keeping your data secure and current.

Exploring QuickBooks Best Practices for Efficiency

Following **QuickBooks best practices** will help you stay organized and retain control of your financial processes. Some practical tips include reviewing financial reports frequently, utilizing keyboard shortcuts for faster navigation, and automating as many processes as possible. By ensuring consistent and accurate data entry, businesses can leverage QuickBooks analytics features to derive actionable business insights.

As your business grows, continuing to evolve your understanding of QuickBooks will ensure that you are equipped to navigate advancements in accounting technology effectively. This guide offers suggestions on how to utilize QuickBooks optimally, but commitment to ongoing training and utilizing resources will pay dividends in becoming proficient in accounting processes.

Key Takeaways

- Understanding core **QuickBooks features** allows firms to streamline accounting operations.

- Effective setup of **QuickBooks** tools is critical for long-term success.

- Utilizing **QuickBooks expense tracking** methods can result in more accurate financial reporting.

- Take advantage of **QuickBooks training** and customer support to enhance the user experience.

- Implementing best practices in QuickBooks usage ensures effective management and data security.

FAQ

1. What are the key benefits of using QuickBooks for managing finances?

QuickBooks offers numerous benefits, including automated invoicing, efficient payroll processing, and robust expense tracking. Businesses benefit from the ability to create customized reports, enhancing financial oversight. Purchasing the software ensures you have access to continuous updates and customer support, which are vital for adapting to a changing business environment.

2. How do I set up QuickBooks for my small business?

Setting up QuickBooks involves defining your chart of accounts, entering starting balances, and customizing settings for your business needs. You can begin by accessing **QuickBooks fundamentals**, such as your income and expenses. QuickBooks also provides guided tutorials on the setup process to help new users.

3. What should I do if I encounter technical issues with QuickBooks?

If you face any technical difficulties, reaching out to **QuickBooks technical support** is recommended. They provide various resources, including troubleshooting guides, user manuals, and community forums. You can also utilize **QuickBooks FAQs** to find quick solutions to common issues.

4. Are there training options available for using QuickBooks?

Yes, QuickBooks offers extensive training materials, including webinars, tutorial videos, and online courses through their learning center. Investing the time in these resources helps users maximize the software’s capabilities and implement improved accounting practices.

5. How can I ensure the data security of my QuickBooks account?

Data security can be enhanced by regularly updating your software for security patches and using **QuickBooks cloud accounting** features for automatic backups. Ensuring strong password policies and utilizing two-factor authentication can further protect sensitive financial data.

Implementing these tips will help you not only familiarize yourself with QuickBooks but also enable your business to operate more efficiently and effectively in managing your accounting needs in 2025.