Effective Ways to Find Expected Value in 2025

Understanding Expected Value

The concept of **expected value** is a fundamental aspect of **probability** and **statistics** that enables individuals and businesses to make informed decisions based on potential outcomes. At its core, expected value refers to the **mean** or average of all possible outcomes of a random variable, weighted by their probabilities. This mathematical expectation serves as a crucial tool in various fields, including **finance**, **insurance**, and **game theory**, enabling risk assessment and strategic planning. For example, when analyzing investment opportunities, the expected value helps investors estimate the potential return on investment (ROI) by considering both the gains and losses that could occur over time.

The Expected Value Formula

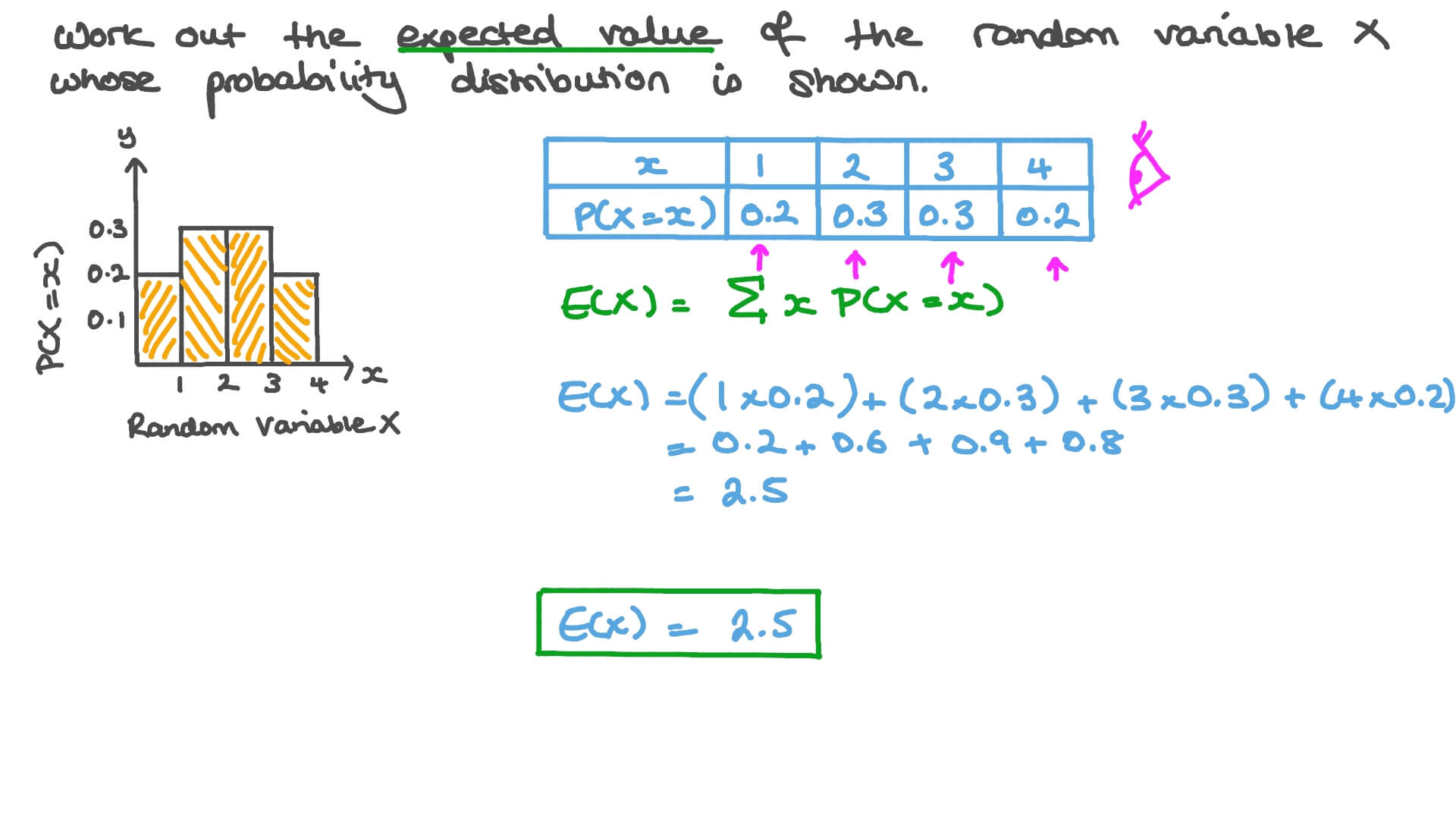

To calculate the expected value, one can use the **expected value formula**, which is expressed mathematically as:

EV = Σ (x * P(x))

where EV represents the expected value, x is the outcome, and P(x) is the probability of that outcome occurring. This formula essentially multiplies each possible outcome by its probability and sums the results to provide a single value that captures the average expected result. By utilizing this calculation, individuals can evaluate scenarios such as consumer purchasing decisions or potential **outcomes** in a gambling situation, where understanding the expected payoff is crucial for strategic gameplay.

Practical Example of Expected Value

Consider a simple gambling scenario, such as rolling a die where winning £6 pays for rolling a six with a probability of 1/6, while not rolling it results in a loss of £1. By applying the expected value formula:

EV = (6 * (1/6)) + (-1 * (5/6))

Simplifying this results in:

EV = 1 – (5/6) = 1/6 or approx 0.17.

In this case, the positive expected value suggests a favorable situation for the player over the long run, informing their decision-making.

Applications of Expected Value in Decision Making

Expected value holds significant implications in decision-making frameworks across various domains by providing quantitative metrics that can guide choices. Applications range from finance and economics to fields such as risk management and strategic planning. In **financial forecasting**, for instance, organizations use expected value calculations to assess potential **expected returns** on different investment options, thus facilitating informed decisions around where to allocate resources. Understanding how to accurately compute expected payoff can make a significant difference in personal finance, such as when evaluating loan vs. investment options.

Utilizing Expected Value in Risk Management

In the realm of risk assessment, companies utilize expected value to quantify risks by identifying the probable financial impacts of uncertain factors. This approach helps them to make better choices around insurances or investments, incorporating risk-return tradeoff principles. By performing simulations and risk analyses, organizations can visualize various possible scenarios and their outcomes through performance evaluation frameworks that include expected values, hence, aligning their operational strategies with their risk appetite. The law of large numbers further supports this by indicating that as the number of trials increases, the average of the outcomes will converge toward the expected value, emphasizing the reliability of long-term predictions.

Impact of Expected Value in Game Theory

The concept of expected value is also prevalent in **game theory**, where it helps players evaluate strategies based on possible outcomes and their associated payoffs. In competitive scenarios, such as auctions or negotiable transactions, participants aim to maximize their expected utility by considering the **probability** distributions of their competitors. A firm understanding of expected value assists in identifying optimal strategies that balance risk and reward, enabling players to make rational choices based on quantitative data. For example, if two competitors bid in an auction, calculating the expected value of each potential bid reflects how each could fare based on possible subsequent actions of competing bidders.

Calculating Expected Value in Real-Time Analytics

In today’s data-driven world, companies rely heavily on **real-time analytics** to estimate expected values dynamically. Leveraging statistical methods and **machine learning models**, organizations can analyze vast datasets and derive insights that enable them to refine operational strategies and make informed business decisions under uncertainty. By implementing predictive modeling and scenario analysis, businesses can assess varying outcomes, effectively weighing potential risks against anticipated rewards in decision-making processes.

Implementing Statistical Methods for Expected Value Calculation

Statistical methods such as regression analysis and **empirical distributions** enhance the accuracy of expected value calculations across multiple economic scenarios. For essence, in investing, using a **variance** measure aids in presenting risks associated with returns, which when combined with expected return calculations, provides a comprehensive view of prospective investments. These analytical techniques underscore the importance of robust data management practices and highlight how organizations can improve their decision-making by adopting advanced statistical tools.

Expected Value in Investment Strategies

Investment management professionals often integrate expected value assessments when constructing asset allocations or stock portfolios. By analyzing the expected returns from various securities, they can optimize their investment strategies without overexposing themselves to **risk**. Understanding the cumulative distribution function of available investments aids in predicting overall performance and aligning individual investment approaches with long-term success. This not only supports optimized monetary growth but also instills confidence among investors as they navigate the marketplace.

Key Takeaways

- Expected value serves as a critical tool for statistical analysis, facilitating strategic planning and decision-making across various fields.

- The expected value formula provides a systematic approach to comprehend potential outcomes based on their respective probabilities.

- Applications in risk management and game theory underscore the practical importance of expected value in understanding complex scenarios.

- Advancements in data analysis and machine learning enhance the accuracy of expected value calculations in real-time, empowering more informed decision-making.

- Appreciation for expected value’s relevance is essential for optimizing financial returns and guiding effective operational strategy.

FAQ

1. What is the expected value definition in probability?

The expected value is a statistical measure used to indicate the average outcome of a random variable by calculating the sum of all possible outcomes multiplied by their probabilities. It serves as a key indicator in **decision-making** scenarios, guiding individuals and businesses in assessing risks and returns across various contexts.

2. How do you calculate expected gains and losses?

Expected gains and losses are calculated using the **expected value formula**, where potential gains and losses are multiplied by their respective probabilities. For instance, calculating an expected gain of £200 with a 25% chance and a potential loss of £100 with a 75% chance would look like EV = (200 * 0.25) + (-100 * 0.75).

3. How are expected value and variance related?

While expected value provides the average outcome, variance measures the spread or dispersion around that mean. Variance allows individuals to understand **risk** associated with the expected value, reflecting how much outcomes can deviate from the average. It supports a deeper risk assessment alongside expected value calculations.

4. Can expected value be used in financial forecasting?

Yes, expected value is integral to **financial forecasting** as it assists in estimating potential financial metrics based on varying scenarios and associated probabilities. By analyzing expected returns and assessments of risks, investors can refine their investment strategies and optimize resource allocation.

5. How does the law of total expectation apply to marginal distributions?

The law of total expectation relates to how overall expected value can be derived by considering different subgroups’ expectations and their respective probabilities. Marginal distributions help in reflecting the chances of occurrence and are essential for understanding expected values in more complex or joint probability scenarios.

6. What are common applications of expected value in gambling?

In gambling, expected value helps players evaluate the profitability of various betting strategies by determining the average payoff over time across different scenarios. Understanding the **expected value** allows gamblers to make informed decisions regarding which games may offer a favorable edge, aiding in risk management and overall gameplay strategy.

7. How do different types of probability distributions affect expected value?

Different types of **probability distributions**, such as discrete and continuous distributions, affect how expected value is calculated. For discrete distributions, the expected value is derived from specific outcomes, while in continuous distributions, it involves integral calculus. This distinction emphasizes the need for tailored strategies when applying expected value across diverse fields such as economics and game theory.