Effective Ways to Build Business Credit in 2025

Understanding Business Credit

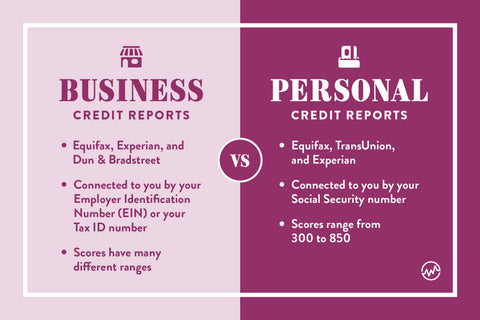

Building **business credit** is essential for entrepreneurs and small businesses seeking to grow and secure financing. Unlike personal credit, which reflects an individual’s financial behavior, **business credit** refers specifically to a company’s creditworthiness. Establishing strong business credit can open the doors to various **business funding options**, including loans, credit cards, and favorable payment terms. This ensures easier access to funds for expansion and operational expenses with better interest rates. In 2025, understanding the nuances of **business credit** will not only enhance your financial flexibility but also improve your overall **business financial health**.

The Importance of a Business Credit Score

Your **business credit score** serves as a snapshot of your company’s creditworthiness. Typically ranging from 0 to 100, a higher score reflects a reliable **credit history for business** operations. Lenders often use this score to determine eligibility for loans and credit lines. It’s not just about obtaining a loan, though; vendors may check this score to extend **vendor credit** or favorable payment terms. Regularly monitoring your **business credit score** allows you to identify any inaccuracies or areas that require improvement. Taking proactive steps can significantly enhance your score and, in turn, your **business credit profile**.

Where to Find Your Business Credit Report

<pObtaining your **business credit report** is crucial for transparency and optimal management. Major **business credit reporting agencies** like Dun & Bradstreet, Experian, and Equifax provide these reports. Each report contains critical information including your credit score, payment history, and any outstanding debts. Understanding how to read and interpret these reports can highlight strengths and weaknesses in your **credit history for business**, enabling better management strategies.

Ways to Establish Business Credit

Starting the path to **establish business credit** requires several fundamental steps. Open a corporate bank account to separate personal and business finances, which lays down the framework for **building strong business credit**. Additionally, obtain an Employer Identification Number (EIN) to register your business with credit agencies effectively. Start building **credit accounts for business** by applying for a small trade credit with suppliers you trust. By consistently paying bills on time, you can establish a solid credit foundation that enhances your creditworthiness.

Proven Strategies to Improve Business Credit

Improving business credit is vital for securing better financing options and building long-lasting vendor relationships. Businesses looking to grow should implement effective **business credit solutions** to boost their score. Some effective strategies include regular monitoring of your **business credit report** and consistently paying all your obligations on time. A robust plan for managing liabilities and diversifying funding sources can have a significant impact over time, leading to positive results.

Utilizing Business Credit Cards

One of the best methods to quickly enhance your **business credit** is by securing **business credit cards** tailor-made for your company’s expenses. By using these cards for business-related purchases and making timely payments, you can build credibility with financial institutions, thereby improving your **credit history for business**. Look for cards that offer rewards or benefits tailored to your industry to maximize the advantages of your spending, while also ensuring those purchases are aimed at **building business credit foundations**.

Engaging with Vendors and Suppliers

Building strong relationships with vendors can provide you with beneficial credit terms that bolster your **business credit development**. Approach vendors who are willing to extend **trade credit** without requiring a flawless credit score. By fulfilling payment timelines diligently, these vendors will report your payments to credit bureaus, contributing positively to your **business credit profile**. As you build credit over time this way, you will effectively create a reliable network that supports your funding strategies.

Using Credit Monitoring Services

Engaging with **business credit monitoring** services can make it easier to stay on top of your credit health. These services allow you to track changes in your credit score, receive alerts for any significant changes in your **business credit report**, and see detailed information regarding your evolving credit situation. Understanding these metrics can guide you in making adjustments or improvements as needed to keep your **business credit** on the right track.

Exploring Business Loans and Financing Options

Securing business loans or funding can often hinge on the **business credit score**. This two-way relationship means that improving your credit has the practical benefit of unlocking more business loan options in the future. It’s crucial to explore diverse financing avenues to determine which options best suits your expanding business. This can range from traditional **bank loans for small businesses** to loans offered by **online lenders for businesses**. Always compare rates, terms, and eligibility before deciding.

Types of Business Loans

Understanding the various **business loan options** available can help you make informed decisions. You might consider secured loans that require collateral or unsecured loans that don’t jeopardize your assets, but often come with stricter conditions and higher interest rates. Another option could be **commercial credit** lines, which allow businesses to draw funds as needed and only pay interest on the portion they use. Choose wisely based on your financial standing and growth objectives, ensuring that the chosen route aligns with your **credit utilization for business**.

Accessing Funding for New Businesses

If you’re just starting, it’s paramount to explore **funding for new businesses** strategically. In addition to traditional funding sources, consider reaching out for business development grants and pitching to angel investors or venture capitalists. Other options include crowdfunding or seeking out short-term loans designed for startups, effectively leveraging your personal network for support. The goal should be to create a mix of funding sources that allow for flexibly scaling your business while also effectively managing **business debt**.

Recognizing Common Pitfalls

When navigating business credit strategies, there are common credit mistakes to avoid. Failing to monitor your **business credit report** can lead to unrecognized issues that may hinder your credibility. Neglecting to separate personal and business finances can compromise both your personal and your business credit scores. Understanding the **impact of personal credit on business** should be prioritized to avoid pitfalls. Streamline your strategies to be proactive rather than reactive, ensuring that your business credit remains robust and positions you favorably for future investments.

Key Takeaways

- Establishing business credit is foundational for accessing financing options.

- Improving your business credit score requires responsible borrowing and timely payments.

- Vendor relationships and business credit cards play a significant role in building business credit.

- Utilize credit monitoring services to stay updated on your credit profile.

- Avoid common pitfalls by maintaining a clear separation between personal and business finances.

FAQ

1. What is the importance of a business credit score?

A **business credit score** reflects your company’s creditworthiness. It’s crucial for securing loans, vendor credit, and negotiating payment terms. A higher score means more trust from lenders, opening more financial opportunities for your business.

2. How can I quickly build business credit?

To **build business credit quickly**, separate your business and personal finances, open a business bank account, apply for a business credit card, and consistently make timely payments. This establishes a positive credit history faster.

3. Can I use personal credit to secure business loans?

Yes, many lenders consider **personal credit vs business credit** when evaluating loan applications. A strong personal credit history may help you qualify for needed business financing, especially when starting.

4. What are vendor credit accounts, and how do they work?

**Vendor credit accounts** allow businesses to purchase goods and services with deferred payment terms. This helps improve your business credit score and establish a track record with suppliers who report your payment history to credit agencies.

5. What are common mistakes when managing business credit?

Common mistakes include failing to monitor your **business credit report**, mixing personal and business finances, and not establishing credit relationships with vendors. These can negatively impact your creditworthiness.

6. How often should I check my business credit report?

It’s wise to check your **business credit report** at least once a year, but more frequent monitoring can help address discrepancies, track progress, and maintain a solid credit profile.

7. What should I consider when applying for business credit lines?

When applying for **business credit lines**, consider the interest rates, repayment terms, fees, and your credit score. Ensure that the credit line aligns with your business needs and financial capabilities.

—