Effective Ways to Become an Accountant: Start Your Career Journey in 2025

Deciding to pursue a career in accounting opens up numerous opportunities within the finance sector. In 2025, understanding the process of becoming an accountant will be essential as the industry continues to evolve. This guide will cover the crucial accountant education requirements, necessary accounting certifications, and tips on navigating the exciting accountant career path ahead.

Understanding Accountant Education Requirements

Before diving into the world of accounting, it’s essential to have a solid educational foundation. A relevant degree, such as a bachelor’s in accounting or finance, is typically required to start your journey in accounting. Most accounting degree programs cover fundamental topics like financial reporting, tax preparation, and management accounting, equipping students with the necessary skills for their future roles. However, earning just a degree may not be enough in today’s competitive job market.

Types of Accounting Degrees

When pursuing your accounting education, understanding the different accounting degree programs available is crucial. The most common degree is a Bachelor of Science in Accounting, but students can also consider specialized degrees like a Bachelor in Management Accounting or Finance. Advanced degrees, such as a Master’s in Accounting, can further enhance your prospects. Additionally, some institutions offer online programs, providing flexibility for working professionals eager to earn their qualifications while managing life’s other responsibilities.

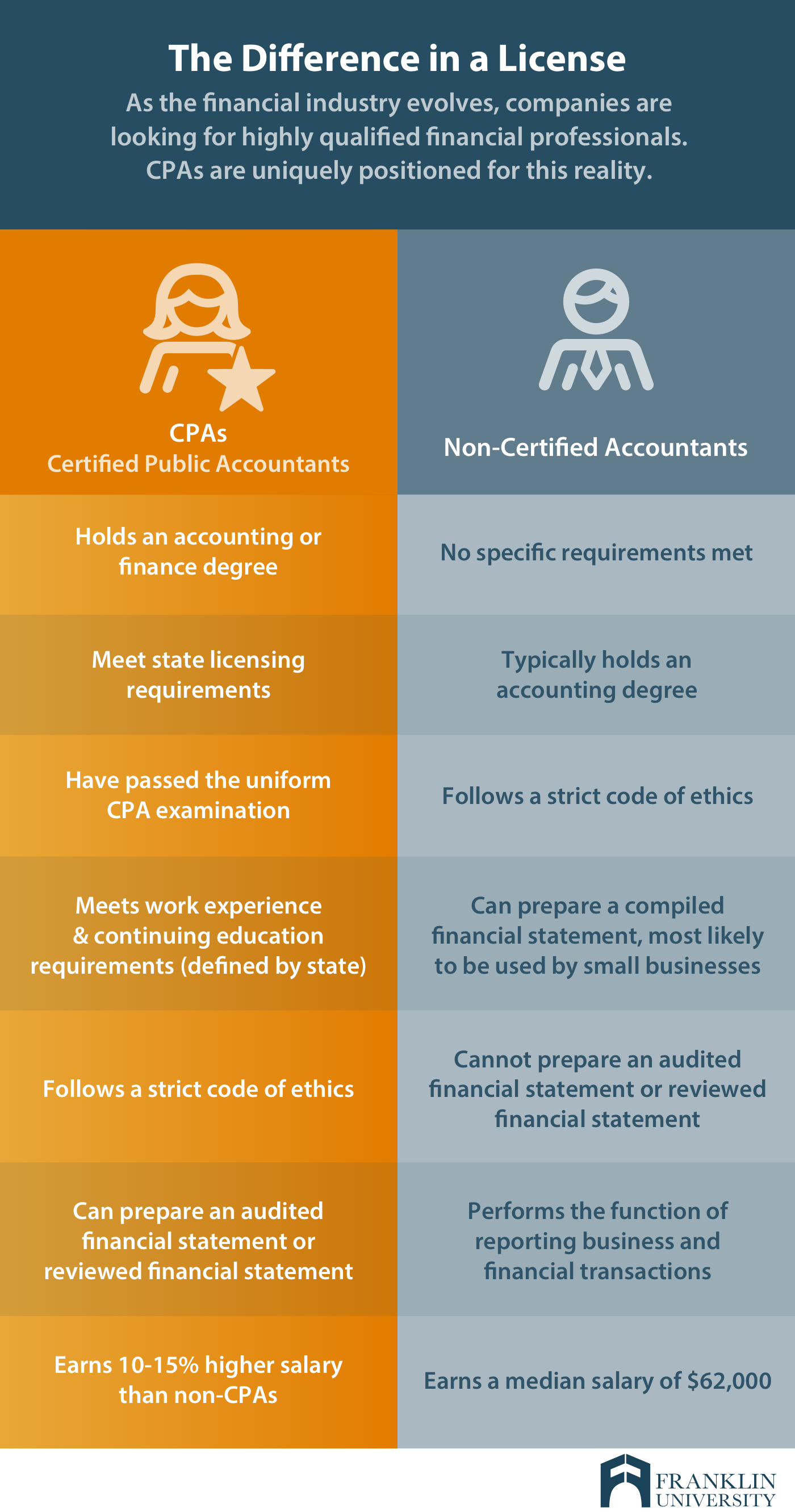

Importance of Accounting Certifications

Gaining a professional qualification can set you apart from the competition in the accounting field. Certifications such as the Certified Public Accountant (CPA) and others, like the Certified Management Accountant (CMA) or Certified Internal Auditor (CIA), are highly respected in the industry. These accounting certifications demonstrate your mastery of crucial accounting principles and compliance with ethical standards. Before you consider taking the CPA exam, ensure that you prepare thoroughly to increase your chance of success!

Acquiring Accounting Skills and Experience

Practical experience is invaluable in transitioning from beyond theory to real-world applicability in your accounting career. Many aspiring accountants seek accounting internships during their college years, which serve as excellent springboards into the professional world. Internships not only enhance your skills but also provide opportunities to network within professional accounting organizations.

The Value of Accounting Internships

Participating in accounting internships allows students to acquire hands-on experience while gaining exposure to different accounting functions, including bookkeeping skills, financial statement analysis, and the usage of various accounting software. These internships often lead to job offers after graduation, as employers appreciate candidates with practical experience and an understanding of workplace dynamics.

Networking for Accountants

Establishing connections with seasoned professionals is critical as you embark on your accounting career. Join accounting professional organizations, participate in workshops, and attend conferences to build your network. Engage in mentorship programs which can enhance your skill set, provide guidance, and may even lead to job opportunities. Good communication skills are essential here; they will help you articulate your goals to mentors and peers effectively.

Job Responsibilities and Career Path in Accounting

As you gain certification and experience, you will need to familiarize yourself with typical accountant job responsibilities. Accountants are tasked with preparing financial statements, maintaining general ledgers, handling tax preparation, and ensuring compliance with financial regulations. Understanding these roles is crucial for career growth within the profession.

Setting Career Goals in Accounting

When entering the accounting profession, it’s beneficial to set clear career goals for accountants. Whether aiming for roles in public accounting or venturing into corporate finance, outline your desired milestones. Plan for future career advancement in accounting through additional coursework or obtaining specialized certifications in areas like forensic accounting, further distinguishing yourself in the job market.

Financial Analysis Techniques

As accountants progress in their careers, having strong analytical skills becomes increasingly critical. Developing skills in financial analysis techniques will significantly enhance your job performance and allow you to advise businesses on financial health effectively. Learning about budget management, financial forecasting, and risk evaluation will add substantial value to your accounting toolkit.

Preparing for the Job Market

As you near graduation and enter the job market, focusing on some critical elements can enhance your employability. This includes preparing a strong resume tailored to accounting positions, featuring skills relevant to the specific roles for which you are applying. Review job search strategies for accountants and leverage your internships and networking connections.

Interviewing for Accounting Positions

Preparing for interviews in the accounting field requires an understanding of potential questions, including atypical scenarios in principles or ethical standards you may encounter in your day-to-day duties. Focus on conveying time management skills and your commitment to maintaining ethical practices in finance. Highlight any experiences from your internships or coursework where you’ve successfully tackled challenges and supported financial goals.

Exploring Remote Accounting Jobs

The rise of remote work opportunities has transformed the job landscape in the accounting sector. Many companies now offer remote accounting jobs, which allow professionals the flexibility to manage their affairs while still engaging meaningfully with their workplace responsibilities. To succeed in a remote setting, candidates will need proficiency in collaboration tools, communication methods, and adaptability to tackle challenges traditionally faced within office environments.

Key Takeaways

- Choose the right accounting degree and strive for professional certifications.

- Gain practical experience through internships and professional networking.

- Stay informed on job responsibilities, career pathways, and prepare effectively for the job market.

- Enhance accounting skills associated with market trends and workplace software.

FAQ

1. What skills are essential for an aspiring accountant?

Successful accountants need to develop a variety of skills. Key areas include strong analytical skills in accounting, proficiency in accounting software, and effective communication skills for accountants. Focus on overcoming challenges through critical thinking in accounting—successful problem solvers usually excel in the field.

2. How can networking benefit an accounting career?

Network within accounting professional organizations and attend events to meet mentors or leaders in your desired specialty. Establishing connections can lead to internship opportunities, job references, and access to valuable industry insights, which can greatly enhance your accounting career development.

3. How do I prepare for the CPA exam?

Focus on a detailed study plan covering all test areas, including bookkeeping essentials and tax regulations. Joining a certification preparation study group can also provide accountability and support. Online resources and workshops can foster valuable exam preparation techniques.

4. What roles can accountants pursue beyond entry-level positions?

As accountants build experience and acquire further qualifications, they can progress to senior roles like financial analyst, auditing manager, or controller. An understanding of management accounting or specialized sectors, such as corporate finance or taxation, also presents exciting advancement opportunities.

5. What is the future job outlook for accountants?

The accounting job market continues to expand, with emerging trends such as virtual accounting and the integration of technology in financial practices. Keeping abreast of changes and continuous professional development is vital for ensuring not only job security but also career satisfaction in accounting.